"Insane Companies No One (Everyone) Talks About" Episode #3: Roblox

The $30+ billion company creating the digital mall for kids today

Disclaimer: The opinions expressed here are for general informational and entertainment purposes only and are not financial advice or recommendations for any individual or on any specific security or investment product. I do not currently own any shares of Roblox. There is a possibility that I will purchase Roblox shares in the future.

Roblox is a 3D gaming platform where users can create an avatar and play games built by Roblox developers. Think of it like a magical 3D portal where you can go play any games you want with your friends.

The platform uses a blocky 3D aesthetic that is such a ~vibe~. Here’s my avatar with my Jojo Siwa t-shirt that I definitely didn’t buy for myself with my own actual money:

If I had written this post a year ago, Roblox would have definitely been considered an “insane company no one talks about.”

Definitely far from true today lol - in fact it felt like the Roblox IPO was the ONLY thing people were talking about for a few weeks back in the fall when their S1 came out.

Nonetheless, I wanted to write this post because I feel like what Roblox has built is absolutely worthy of a discussion - and the scale of its influence on culture will likely continue to go somewhat unnoticed by us olds.

Roblox’s vision is to create a platform not necessarily just for 3D “games,” but for immersive digital experiences more generally. I liked this quote from their CEO below:

“In the future, as you imagine immersive 3D experiences becoming a more and more prevalent form of interaction and entertainment, you can almost think about the economy right now for making linear video… which is TV, movies, YouTube… and the scale of that. And then you transfer that not just to the gaming ecosphere which is already huge, but the immersive social ecosphere where it’s not just competitive play - it’s hanging out together, it’s learning together, it’s creating together…”

- David Baszucki, Roblox CEO

Roblox has built an ecosystem for creating and sharing digital experiences that has captured the hearts and minds of a generation. I know we’re all a little sick of the word “metaverse” these days, but Roblox is undoubtedly one of the few companies that has successfully captured the first seeds of it.

I’ll go through the company’s past, present, and my thoughts on its future below —>

Roblox Overview 2006 - 2021

Roblox began as a physics simulation program built by David Baszucki and Erik Cassel. After seeing that users enjoyed using the program to build obstacle courses, the founders shifted their focus to user-generated gaming.

Over the last 10+ years, Roblox has been quietly building out a massive ecosystem for user-created games. They built the toolset for developers to create games, the infrastructure to run them, and the portal for users to access them. The platform steadily grew in popularity, and Roblox developers began making substantial revenue.

User growth over the last few years, and especially in the last year during COVID, is absolutely mind-boggling. In the first nine months of 2020, Roblox had over 160mm users and did a stunning $1.2 billion in bookings.

In the fall of this year, Roblox released their highly-anticipated S1. They were planning to IPO in the fall, but changed course after seeing the massive success (mispricing lol) of other highly anticipated IPOs like Airbnb and Doordash.

Last month, Roblox announced that they would instead do a direct listing. They completed their Series H at a whopping $30+ billion valuation, after last being valued in February 2020 for a mere $5 billion (you go a16z we see u out here). The direct listing is expected to happen sometime this year (it was delayed again at the end of January).

Shaping the Lives of Gen Alpha

Roblox is truly a cultural cornerstone for kids today. All you need to do is go talk to someone in this age group to figure out how significant it is. Better yet, ask for their screen time:

Roblox is where many kids are going today to hang out with friends, play games, and chill out. In August of 2020, Roblox had 56 million monthly active users. DAUs grew from 17mm in 2019 to a whopping 31mm in 2020 (54% are under 13). Users are on the service for an average of 2.5 hours PER DAY.

Probably the craziest stat from all of this: over half of all children in the United States have a Roblox account!!!! HALF!!!! This is absolutely insane to me. If you look at something like Twitter, for example, only 22% of all US adults use Twitter. When you consider how influential Twitter is in our lives, it gives you an idea of just how important Roblox is to Gen Alpha.

Expanding the TAM of Gaming

Roblox is an absolute juggernaut - but what’s important here (and what I think could potentially demand such a large valuation for them) is that the company is not so much a gaming company as it is a “social immersive experiences” company. We all know that gaming is a big, lucrative business - and that it’s growing quickly. But Roblox has succeeded in their vision to make a platform around “shared experiences” rather than what might traditionally be described as “games.”

As an example, Roblox partnered with Lil Nas X to host a virtual performance on the platform, which was reportedly viewed over 35mm times.

Here is one of my favorite quotes from the S1:

We call this emerging category "human co-experience," which we consider to be the new form of social interaction we envisioned back in 2004. Our platform is powered by user-generated content and draws inspiration from gaming, entertainment, social media, and even toys.

We can see examples of this by looking at some of the most popular Roblox games and what they are:

Bloxburg - simulation of household / role-play game

MeepCity - casual MMO role-play game

Jailbreak - you’re a prisoner who must escape from jail

Adopt Me! - MMO role-play game with digital pets

Royale High - fantasy school / role-play with a focus on clothing

Work at a Pizza Place - work at a fictional pizza place

Many of these experiences are casual MMOs (massive multiplayer online games) or role-play games. This is definitely a move away from the kinds of games that we tend to associate with “gamers.”

Outside of playing the more popular games, kids are also using Roblox to make things that don’t really look like games at all. For example, take this Roblox recreation of the Hype House:

Another great example: 13 year-old influencer Emery Bingham hosted an “Ariana Grande concert” in Roblox, wherein she played Ariana in an unbelievably exact Roblox recreation of the actual Ariana Grande Sweetener World Tour set.

During the live concert, Emery “performed” as Grande on the 3D stage while playing the actual live album in the experience. She matched all of the set design and costumes as well, and even sold them to her fans for “Robux” (Roblox’s in-game currency that users can purchase).

In the same way that my friends and I used to pretend we were on Disney channel growing up, kids today are using Roblox (and TikTok!) to express their own inner worlds.

The world of gaming is traditionally dominated by male developers and male consumers (first-person shooters, Fortnite stuff, you get the gist), but 40% of Roblox’s users are female and the content is, in many ways, much more female as well. Roblox is expanding what it means to game, what it means to create, and what it means to hang out with your friends digitally. It’s truly an incredible company.

The Business

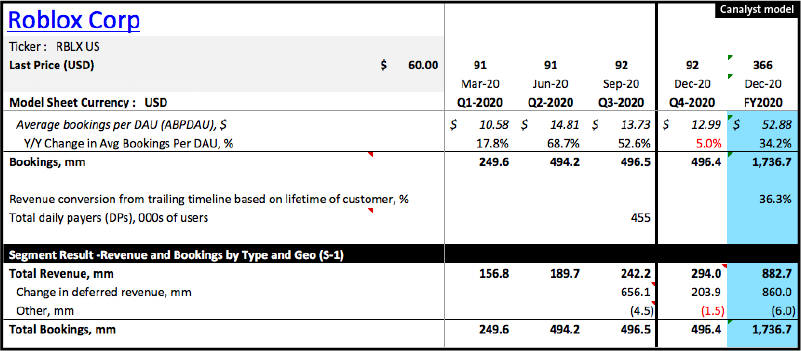

It’s clear that Roblox has huge cultural significance today, and that the company clearly intends to expand on this after going public. But how does this translate to money, and how sustainable is it? For this part of my analysis, I partnered with Canalyst. Below, you will find references to their $RBLX model.

Almost all of the experiences on Roblox are user-generated content made by Roblox Developers and Creators. Roblox makes money by serving as the linchpin between consumers who want to play games with their friends, and the 7 million+ people who want to make money from their creations.

In the S1, Roblox refers to users who make games as “Developers” and users who make avatar accessories and customizations as “Creators.”

Here’s how it works: users come to the Roblox platform, purchase “Robux” with IRL currency, and then spend the Robux on gaming experiences and/or avatar items. Developers and Creators can then “cash out” by converting their earned Robux revenue back to IRL currency.

There are three core aspects of the platform:

Roblox Client - allows users to explore 3D worlds

Roblox Studio - the toolset developers use to build virtual worlds and items

Roblox Cloud - the infrastructure that powers the entire platform

Revenue

Roblox makes money primarily by keeping a percentage of the Robux earned by Developers and Creators. Most games on Roblox are free-to-play, and Developers make money by selling in-game content and/or avatar upgrades and items. The Roblox cut is ~30% for Developers and ~70% for Creators.

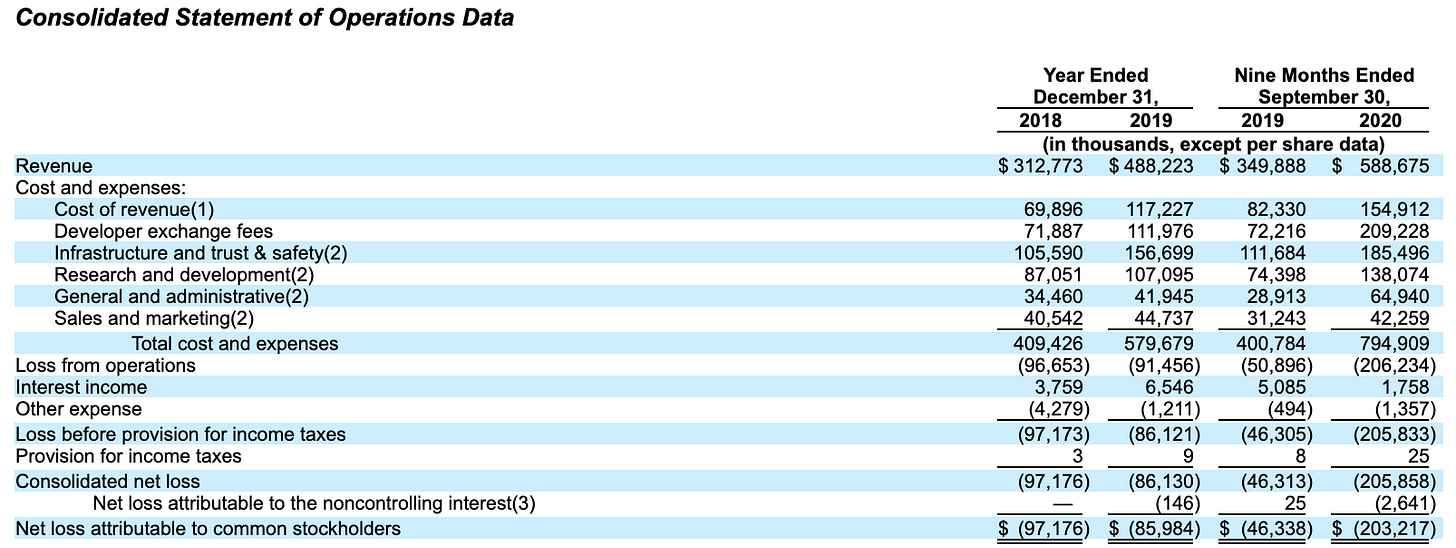

Revenue grew 56% from $312.8 million in 2018 to $488.2 million in 2019, and grew 68% from $349.9 million in the nine months ended September 30, 2019 to a whopping $588.7 million in the nine months ended September 30, 2020. Holidays are the biggest months for them, driving year-end estimates of ~$880mm for FY2020:

Roblox records “bookings” when a user purchases Robux - but they don’t recognize it as “revenue” until it is amortized throughout a user’s 23-month “lifetime.” (This is standard practice for most gaming companies, but the application here is somewhat conservative in my opinion.)

Roblox did $1.24 billion in bookings in the first 9 months of 2020, which is up 171% from $458 million over the same period in 2019 (!!!!). This is absolutely nuts, and is largely credited to COVID and the increased need to connect with others digitally while social distancing.

This bump in engagement from COVID has proven to be at least somewhat temporary - average booking per DAU (ABPDAU) was $13.73 for Q3 2020, which is down slightly from $14.81 in the prior quarter. Q4 has historically always been great for Roblox - so it’s ultimately too early to tell how much of Roblox’s increased COVID engagement will truly stick for the long-term.

Costs

In the first nine months of 2020, revenue was up 68% to $588.7mm. During that time period, losses quadrupled from $46.3mm to $203.2mm. This is largely due to the way the way they don’t recognize revenue until later (costs hit the books when they are incurred rather than when Roblox actualizes the associated revenue).

Cost of Revenue consists mainly of the fees that are paid out to the many distributors that Roblox operates on (Apple, Google, XBox, Windows, some VR headsets, etc.). It’s pretty wild how large this is (currently 26% of revenue), and illustrates some of the issues Roblox could face down the road having to rely on these distributors to reach users.

Developer Exchange Fees make up what gets paid out to Developers and Creators. This made up a significantly larger percentage of revenue over the first 9 months of 2020 when COVID hit, which actually is indicative of the scale that Roblox can theoretically achieve for its marketplace with a large increase in both users and engagement.

Other notes about costs:

Infrastructure and Trust and Safety is another relatively large cost. It takes a substantial amount of engineering power to keep Roblox up and running. Also, Roblox currently employs over 1500 moderators!

Sales and Marketing costs are very minimal at $40mm (less than 10% of revenue).

R&D and G&A also make up a relatively consistent aspect of costs, and will ideally decrease on a percentage basis somewhat as Roblox scales.

Keeping Developers Happy

Roblox currently has 7+ million Developers across 170 countries powering 18+ million experiences. (Again, the S1 refers to users who make games as “Developers” and users who make avatar customizations as “Creators.”)

It’s difficult to make money on Roblox. Of the 960,000 Developers and Creators that were on the platform as of September 30, 2020, only 1,050 of them made $10,000+ and only 250 made $100,000+. Less than 50 made $1,000,000+.

At the end of the day, the hit games drive most of consumer spending and time spent. Developers only keep a relatively small percentage of the revenue. On top of that, Developers and Creators must operate exclusively within the Roblox ecosystem, and script in Lua.

In the same way that Spotify gave rise to a “middle class” of music creators, I think Roblox needs to do more work to empower their own “middle class” of Creators. To do this, I think they need to focus on avatar customizations in particular. People like Emery Bingham, for example, have large fan bases and are actively building Roblox items for their fans. They are not looking to become game studios, but they ARE looking to engage with others, build community, and make ancillary revenue within the 3D identity-driven space that they use as a social medium of expression.

Roblox is definitely making moves towards doing this. In late 2019, they opened up the Avatar Store to Creators and began to see great success. (Prior to this, all of the avatar items were published by Roblox themselves.)

IMO, the two biggest things Roblox can do to become a successful company long-term is:

(1) Attract and retain older users

(2) Prioritize building out their mobiles app(s) to more closely reflect an avatar-driven social network (rather than just a portal for games)

Attracting and Retaining Older Users

Roblox needs to attract older users in the US and Canada, or at least continue attracting younger users while retaining the older users as they age. This will be critical - in my opinion, this is one of the biggest risks to owning Roblox as a business. 67% of DAUs are from outside the US and Canada, but 68% of bookings are from the US and Canada - and older users are much more likely to spend money.

Every generation experiences the coming and going of massively popular games and platforms. Consumers are quick to move on when they outgrow places that are “for kids.” We have seen this happen dozens of times with kids’ games, and to a lesser extent with kids’ platforms (ex: much of Musical.ly’s stall in later growth was attributed to users’ moving over to more “mature” platforms like Instagram and YouTube.)

The current iOS app is really kid-friendly, and Roblox has invested heavily in safety + moderation (they are fully COPPA-compliant). This is awesome, and has likely been a key reason why Roblox has been so successful in recent years. But at the same time, I think some of these features can make the app feel more like a kid game than a social media app (ex: I am a registered user over 13 in the app, but I was blocked from sending the word “lmao” to my 20 something yr old friend [who was also a registered user over 13] in chat).

Attracting an older user base will have a compounding network effect - it will keep the platform fresh and make it feel more like a social networking app. Furthermore, older users are more likely to actually spend money on the platform.

Roblox has been successful in slowly growing their 13+ user base (especially in the last year during COVID), but I think they will need to make a number of big product changes to their mobile app in order to gain real traction in an older age group. I’ll elaborate on these in the next section.

Improve Mobile App with Focus on Social Networking

Mobile is critical for Roblox’s long-term sustainability. For the nine months ended September 30, 2020, 34% of Roblox’s revenue was attributable to Robux sales through the Apple App Store and 18% was attributable to the Google Play Store. During this same period, 68% of engagement hours on the platform were from users who signed up through the Apple App Store and Google Play Store (!).

Despite this, Roblox’s mobile app is not very good - it is clunky and feels a bit like a desktop app ported over to mobile than a mobile app. It is possible to add friends and chat with them, but social features outside of that are limited and discoverability is difficult.

IMO, improving the mobile app so that users can rely on it as both a portal for games and also as an avatar-driven social network would attract older users, make the platform stickier over time, and also improve long-term monetization prospects by empowering the “middle class” of Creators who make avatar items.

Roblox needs to improve the app generally (functionality, performance, UX, etc.), and also make it easier to add/find friends, connect with friends-of-friends, audio chat, and create groups. Ultimately, Roblox should become the social app where it’s relatively frictionless to be chatting with a group of friends and then spontaneously jump into a game or experience together… Or get together with your science class and prep for a test by building 3D models and audio chatting together. For this vision to come together, all of the different networks of a user’s life need to be easily discoverable and accessible from within the mobile app itself. (Obviously, there are many COPPA restrictions that come into play here - but I am speaking about this in the context of the 13+ age group.)

Roblox set up Party Place in July 2020, which allows users to casually hang out and set up a private server for a birthday. This is super cool, and imo is an example of the exact kind of “lightweight” social product features that Roblox should hone in on.

These sorts of changes would bring a renewed focus to identity and to the user’s avatar. If the Roblox app can become a place where users log in with the intention of “immersively connecting with my network” rather than a place where users log in solely with the intention of “gaming,” users would likely be much more incentivized to purchase avatar items. Roblox could become the default platform where users go to express their identity in 3D. This will help the platform scale and generate more revenue. (Note: This TikTok and the comments are funny as hell and very illuminating - you can see that Roblox has already captured quite a bit of this.)

We have seen with companies like Tencent that a powerful position in gaming can both leverage and be leveraged by social graphs. Roblox’s potential to establish and leverage users’ social graphs will also be strategic defense to the many other UGC gaming platforms that are trying to play in this space (most notably are Minecraft, Free Fire, and Fortnite Creative).

Roblox has accomplished an incredible technical feat in building out such a robust underlying infrastructure and marketplace. This is a huge, sticky strength and I definitely don’t want to downplay it by any means. But I do think that placing more strategic focus on these more “front-end” social product features will help them maintain their moat going forward. This will be one of the key things I will look for on earnings calls throughout 2021.

Playing Nice with Apple and Google

Mobile is key for Roblox, and they note the associated risks in their S1:

Because of the significant use of our platform on mobile devices, our application must remain interoperable with these and other popular mobile app stores and platforms, and related hardware.

On a spectrum of “clearly violating Apple’s app store rules” to “definitely not violating Apple’s app store rules,” Roblox is much closer to the former than the latter. Roblox offers an in-app “app store” where you can load games and stream code that is not approved by Apple, and they seem to sit in a number of gray areas with respect to the use and distribution of Robux.

It’s no secret that Apple does not treat developers equally. Rules that apply to one large partner might not apply to another in the same way. (Facebook, for example, has been pretty vocal about their frustrating relationship with Apple and the Facebook gaming app.)

The key here is that Roblox plays by the rules with in-app purchases. It pays a percentage to Apple off of every transaction, and this represents a significant cost for their operations.

If Roblox continues to generate a lot of revenue and willingly pay the associated fees out to Apple, I don’t foresee their reliance on Apple becoming an issue (outside of the fact that it’s a major cost to them and Developers/Creators). Also, the Roblox Client operates on additional platforms like Android, PC, Mac, Xbox, Oculus, and Vive.

That said, the Apple risk in particular is worth noting because removal from the iOS app store would hurt Roblox tremendously with respect to the demographic that it needs to grow into. (It is difficult to succeed in growing the TAM of gaming among users 13+ in North America without reaching iPhone users.)

Leadership

Roblox has excellent leadership. Baszucki, their CEO, is clearly a long-term thinker with a big vision. He has spent nearly his entire career in interactive software with a particular focus on social. (In fact, he was a seed investor in Friendster!)

Baszucki has 70% voting power and 12% ownership of the company. Some investors don’t like seeing heavily concentrated voting power among founders, but this is actually something I really like in a company - companies are largely founder-driven, and it’s great to know that they have a great founder at the helm.

Here’s a great video of him speaking at Slush 2018 about Roblox’s larger vision:

Now What?

Roblox is an incredible company and I have so much admiration for them, but I will wait until we go through a few earnings calls before deciding whether or not I want to own the stock long-term.

I think Roblox has an amazing opportunity to build out the metaverse and to expand what it means to “game,” but I think they need to hone in on their mobile app and social networking product features in order to truly scale as a business. I think that doing so will help them attract and retain older users, remain sticky long-term, and improve monetization by expanding opportunities for Creators.

I’m so excited to add $RBLX to the list of companies I follow. Follow me on twitter here for more coverage as we move into 2021!

Awesome

I think they are going to expand into VR in a very meaningful way. Love this write up